Project 06 of 10

Client: NZTE

Role: UX & UI Design

Year: 2021

The existing claims system involved separate platforms for customer claim submissions and advisor reviews, both requiring extensive manual processing. To meet the goal of reducing the IGF team size while increasing customer funding, our focus was on automating as much of the claim process as possible.

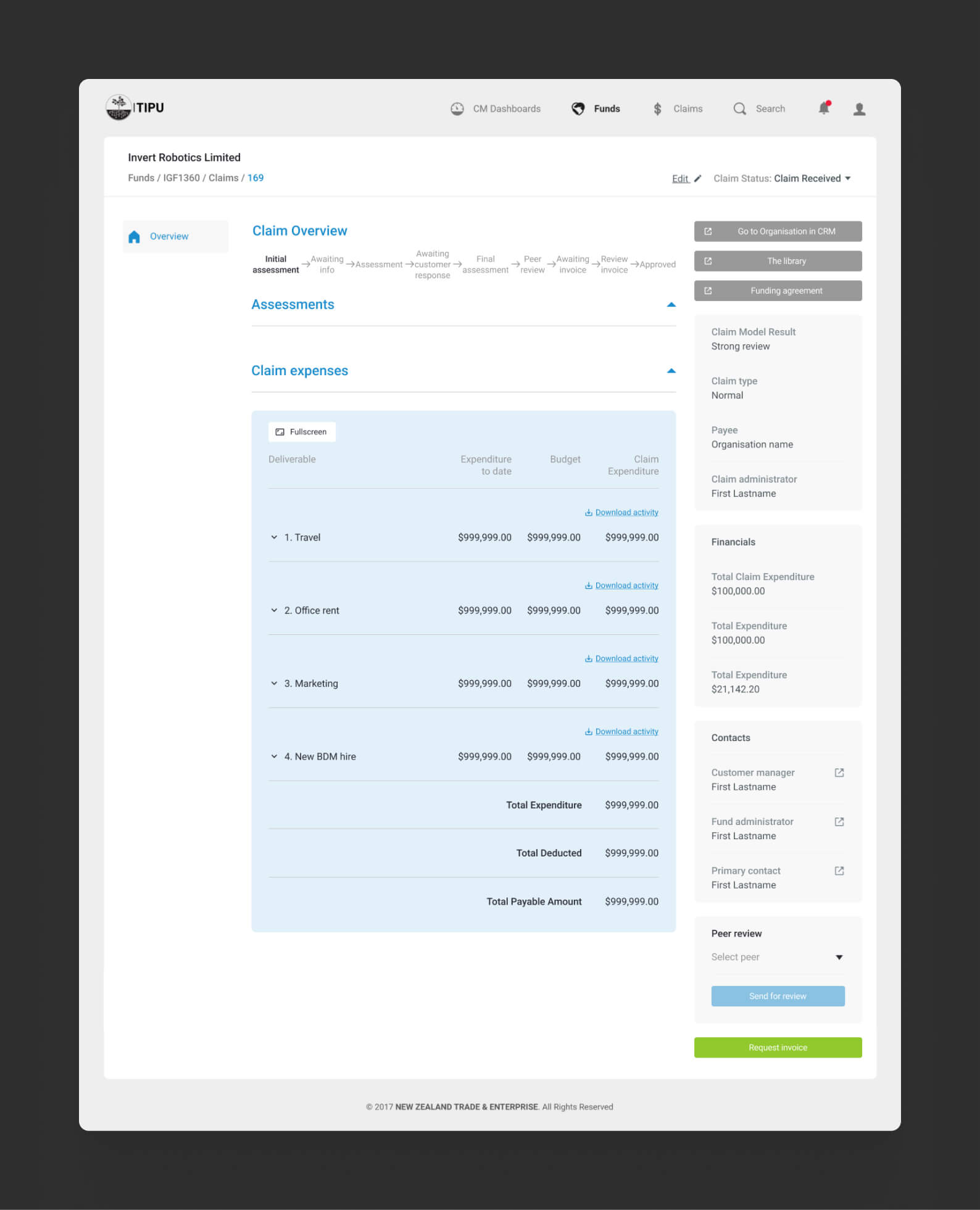

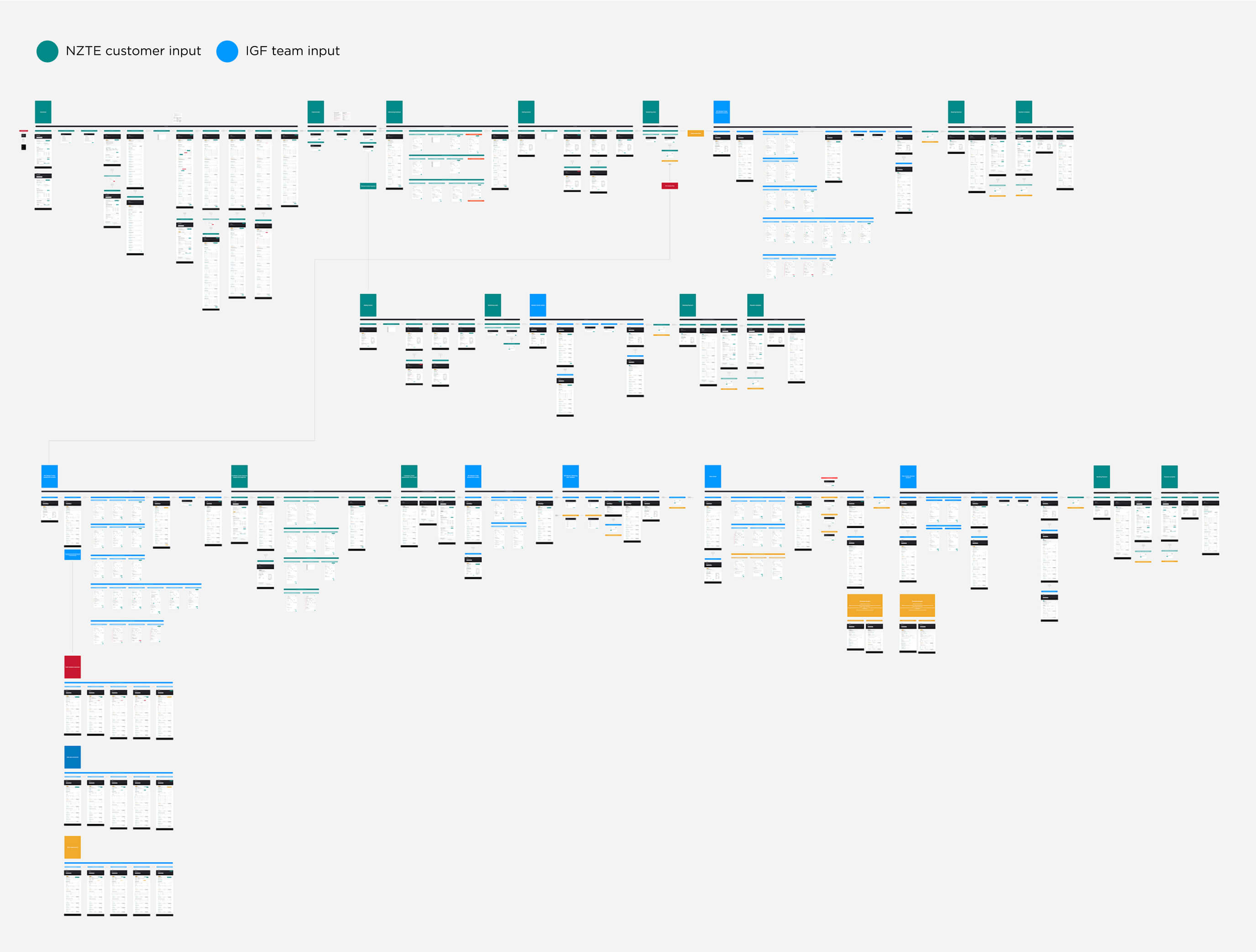

To thoroughly grasp the pain points experienced by the advisory team with the current platform, I conducted a comprehensive series of user interviews with the IGF team to fully understand the claims process. I then designed the existing journey in their existing platform, requiring over 180 screens to document the existing internal claims process.

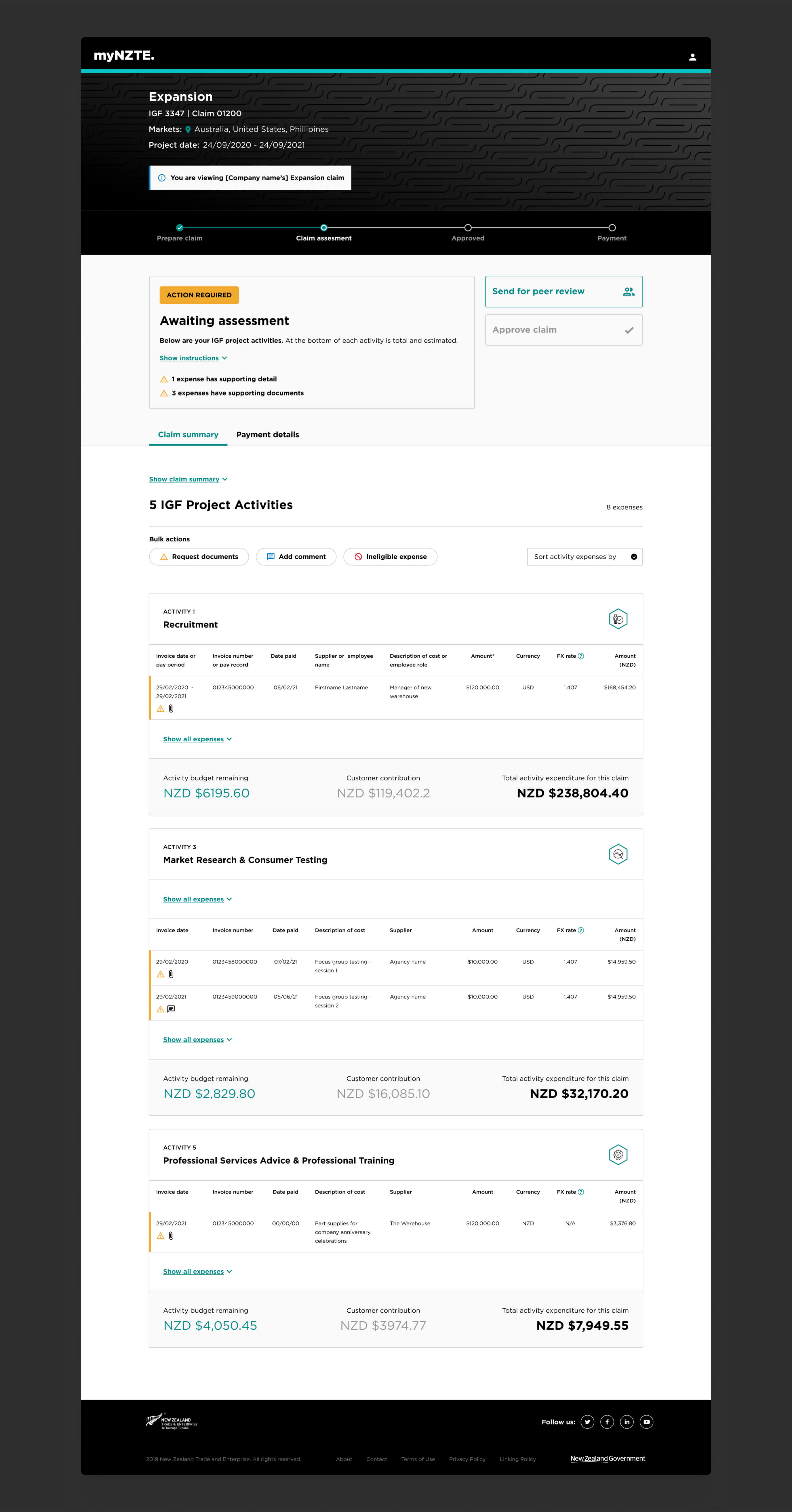

The previous claims system utilised separate platforms for customer submissions and advisor reviews, necessitating manual processing. Our objective of optimising the IGF team's efficiency while enhancing customer funding led us to prioritise automation within the claim process. Through comprehensive restructuring in collaboration with the IGF team, we streamlined operations, minimising correspondence and feedback cycles.

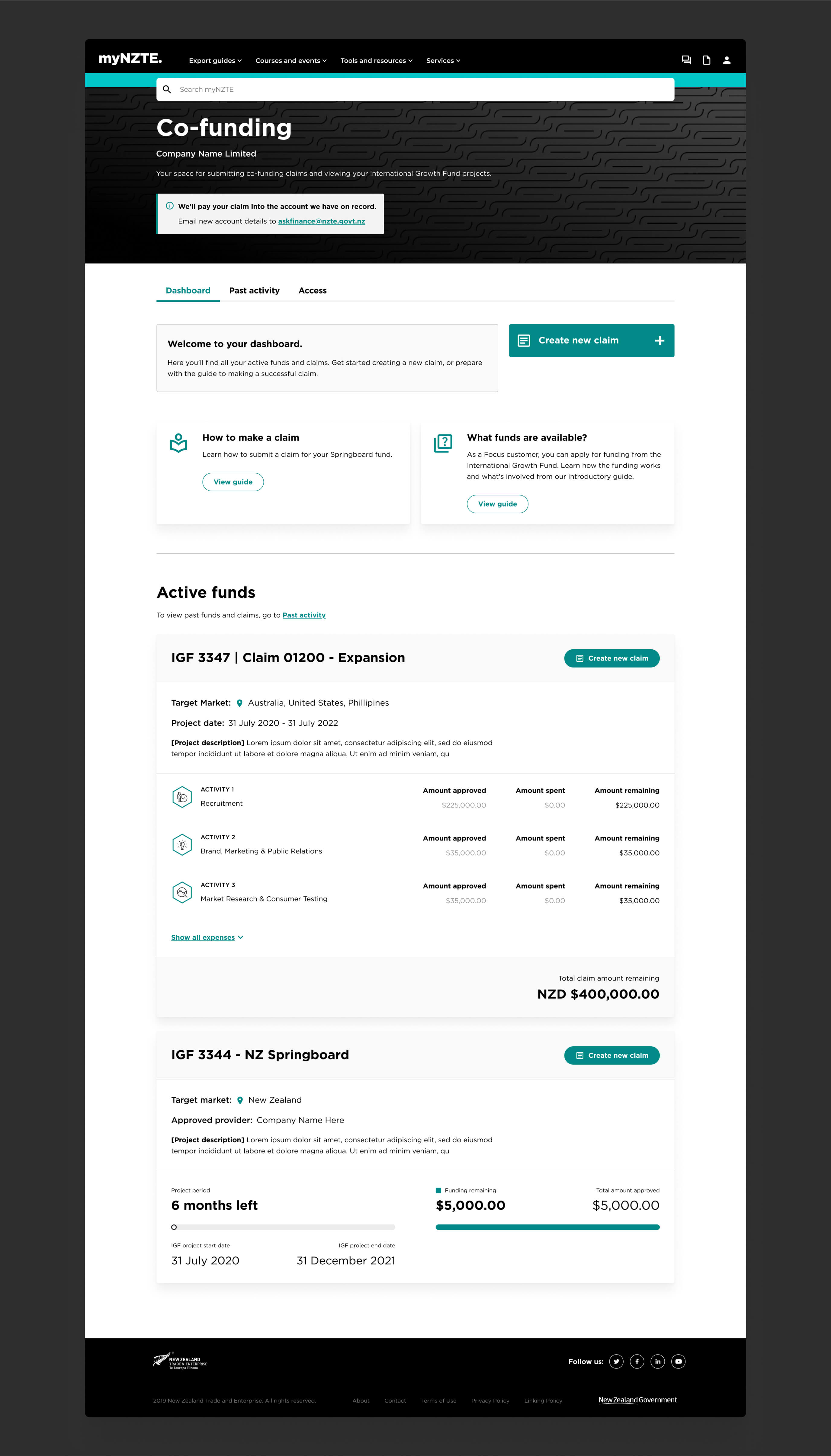

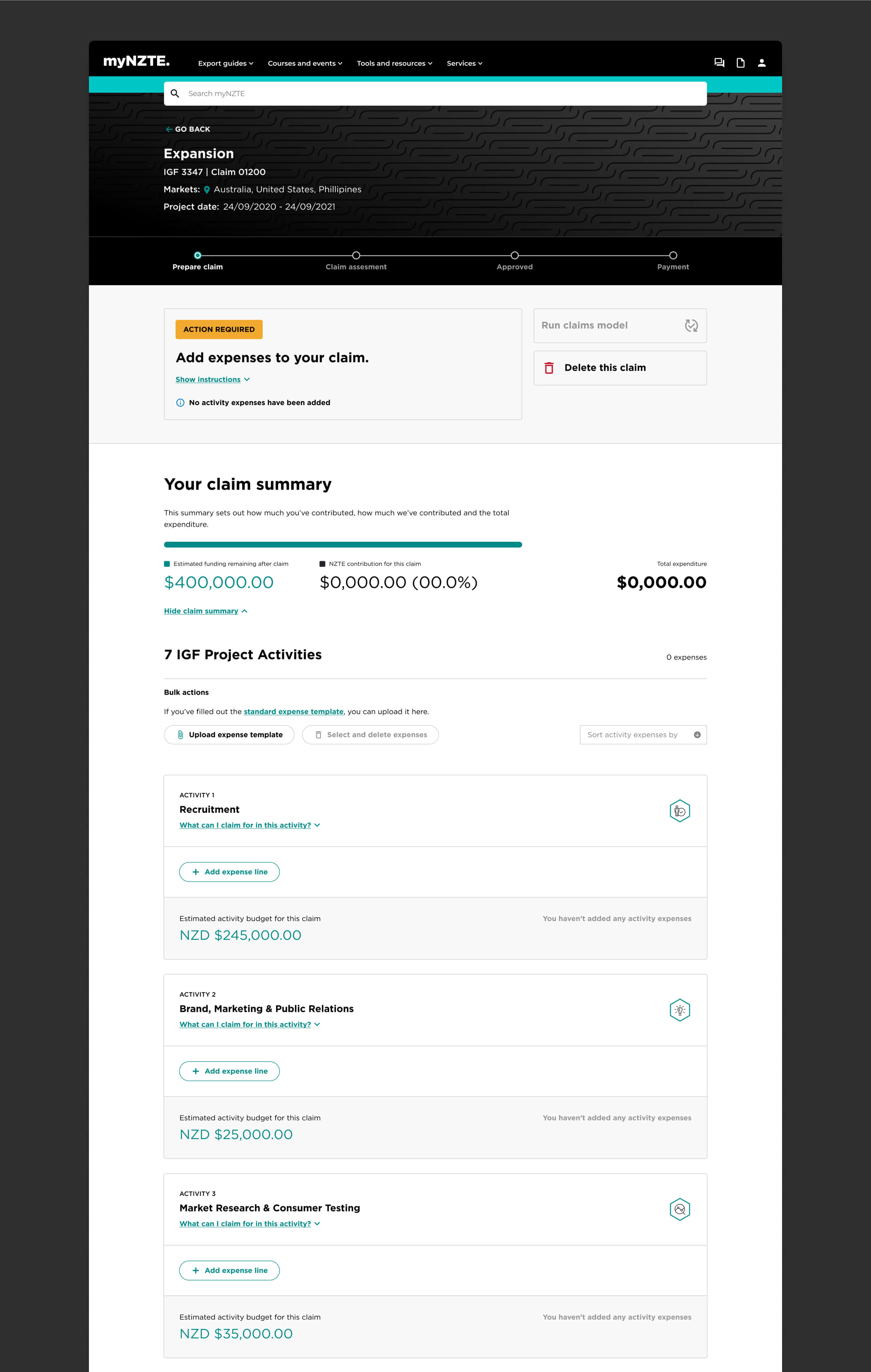

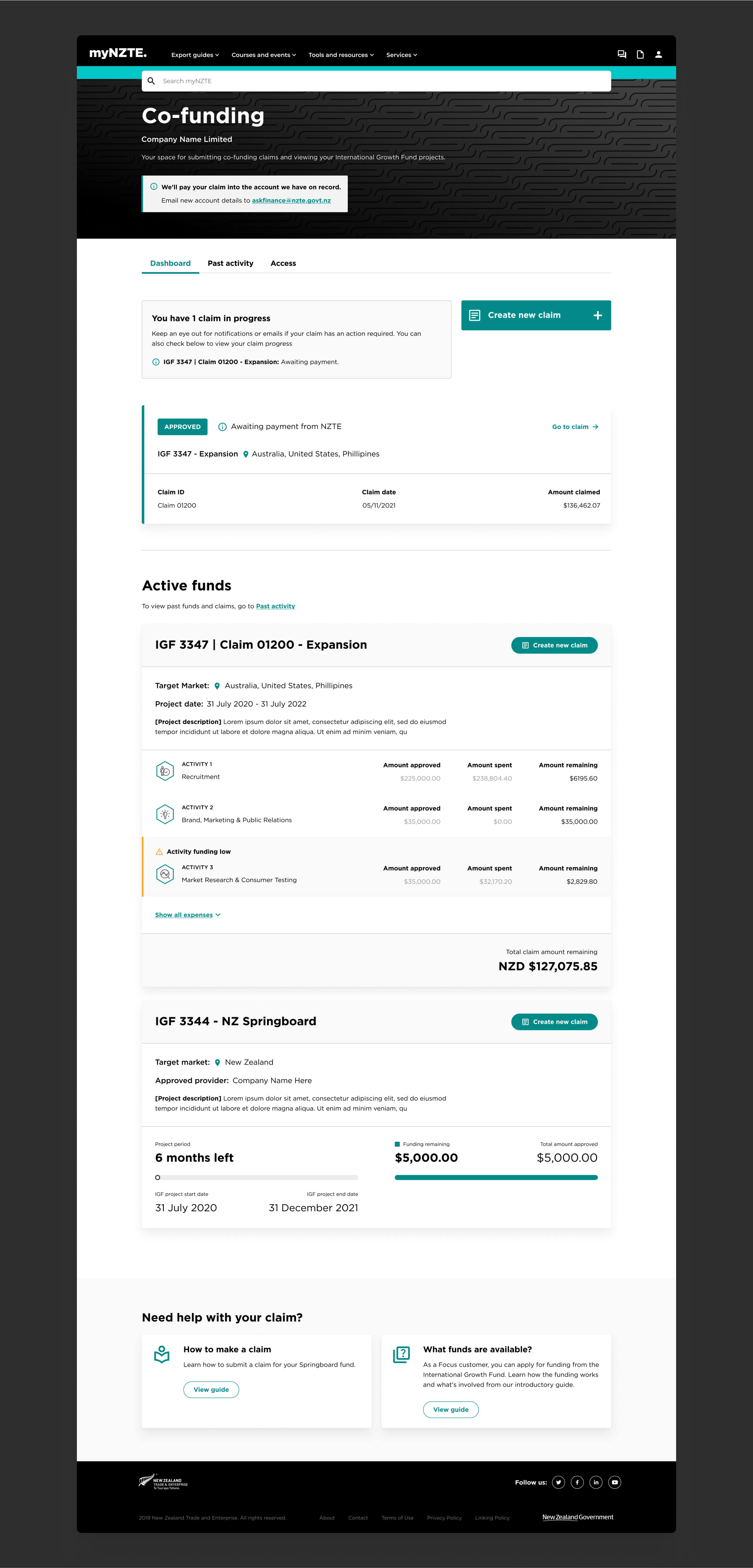

We consolidated all available funds for customers into a single dashboard, providing them with a clear view of their available funds and their progress within the funding cycle.

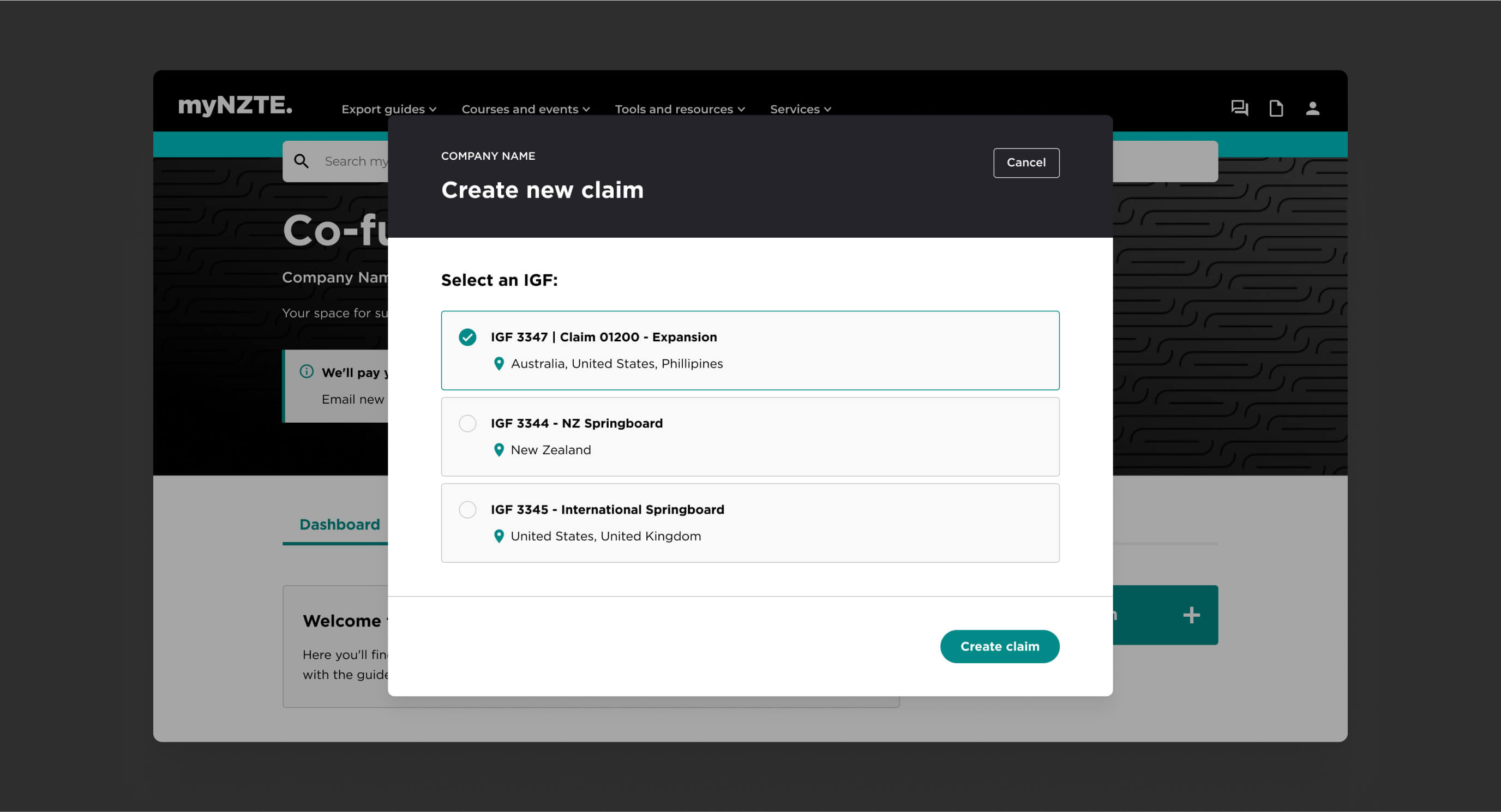

With the new centralised dashboard, customers could now easily select which fund they were claiming against when creating a new claim.

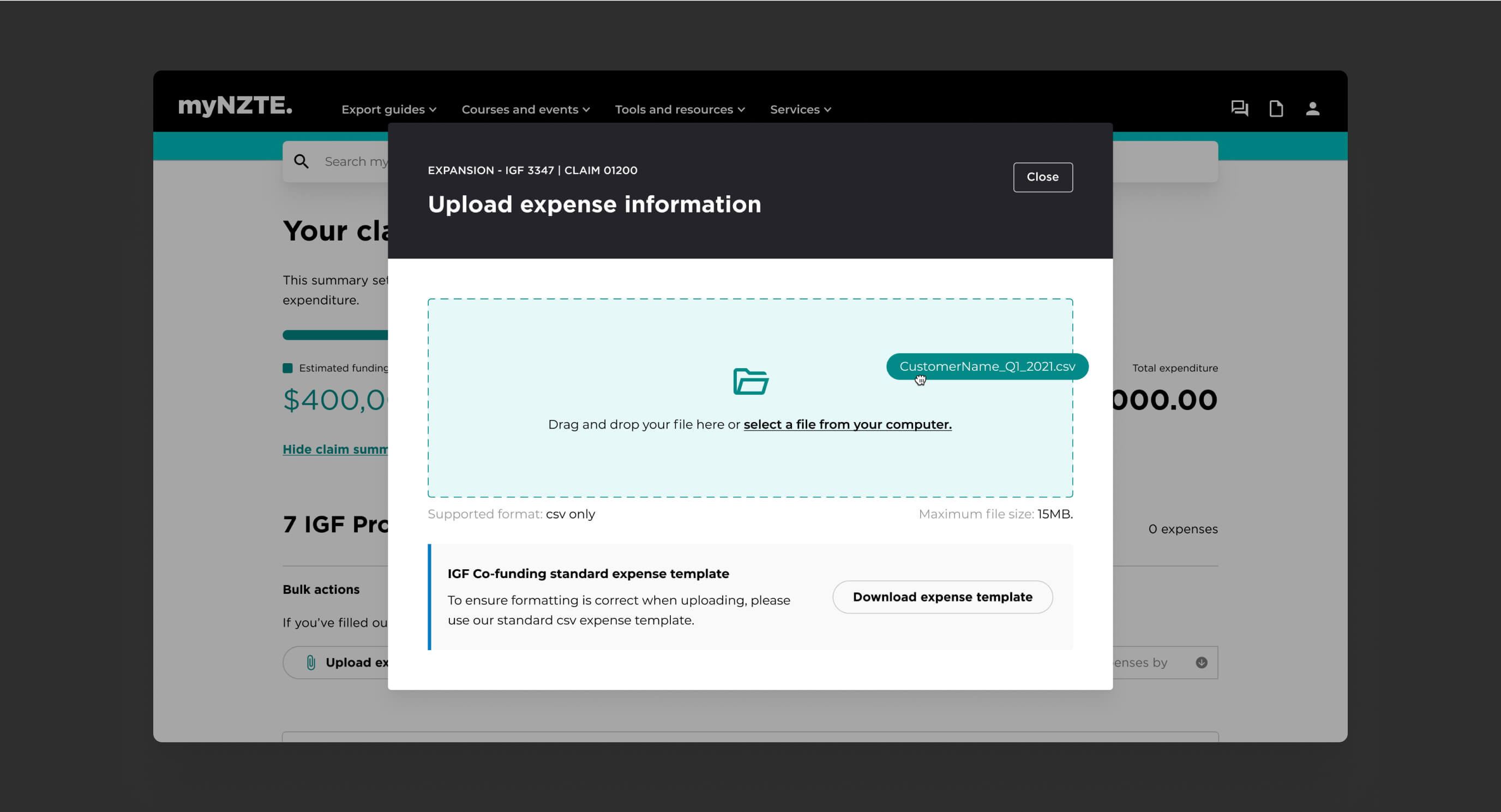

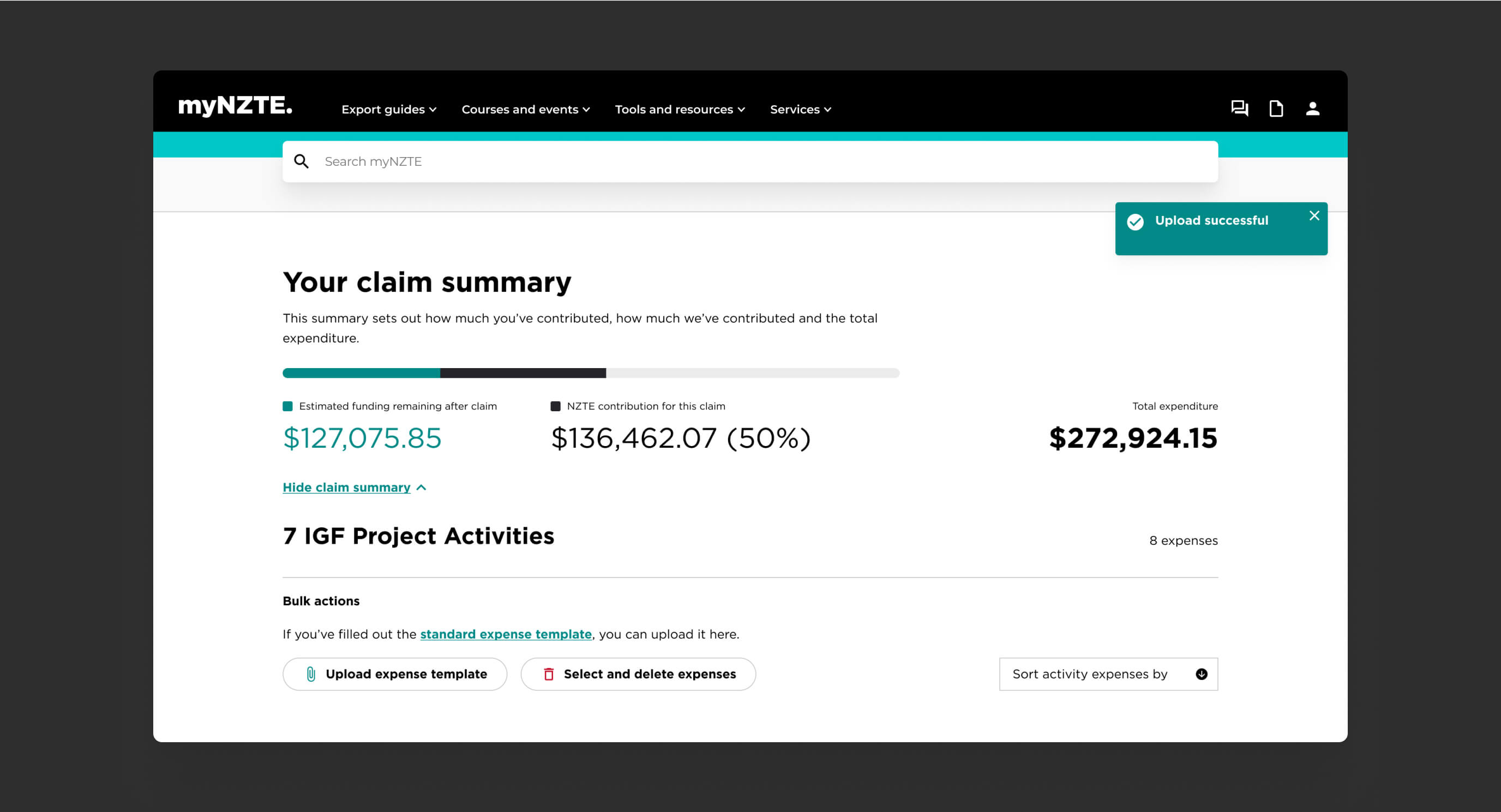

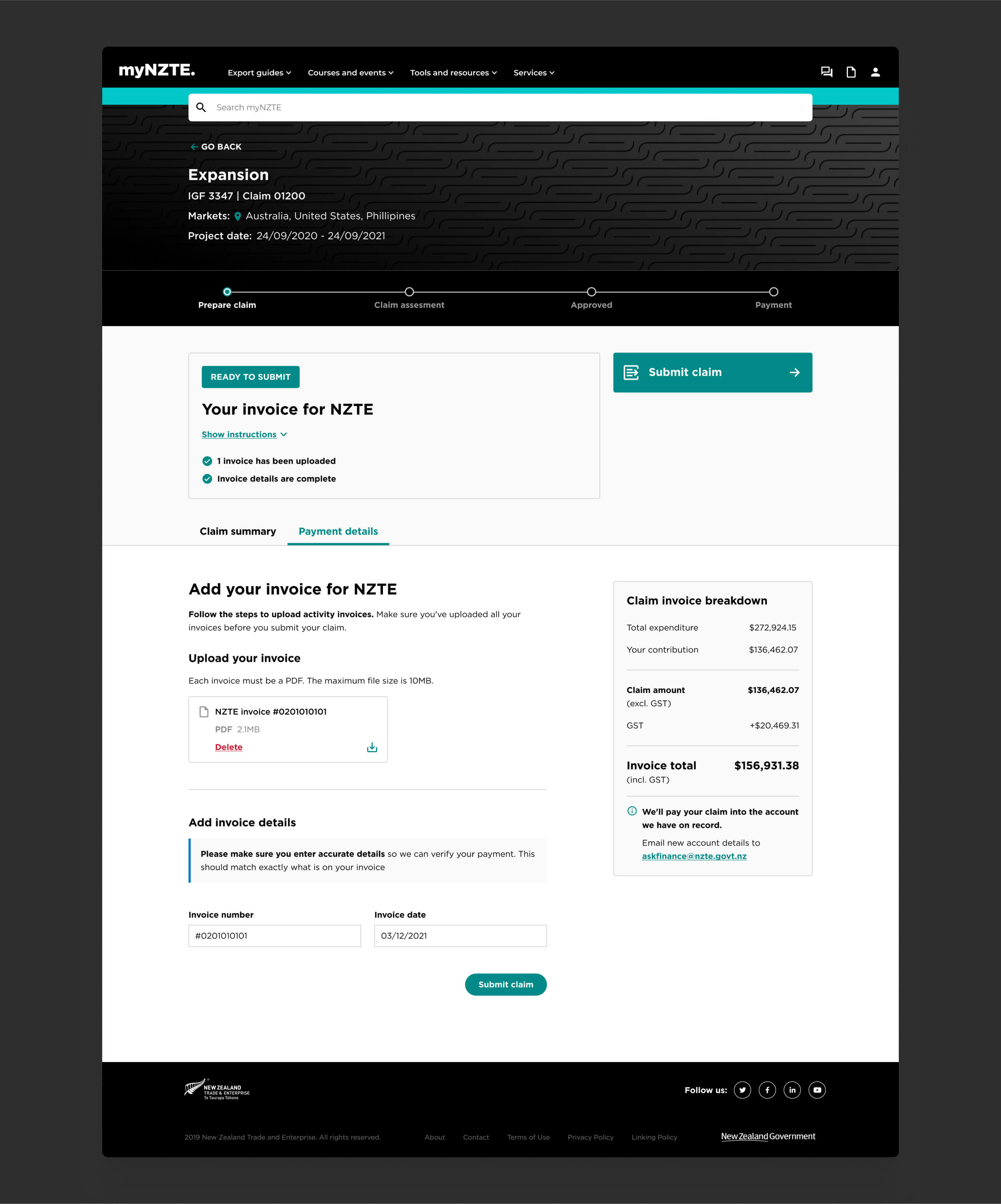

We introduced the capability for customers to use our IGF co-funding CSV template to upload expenditure CSV files directly to their claim, greatly improving the customer claim experience and minimising manual errors.

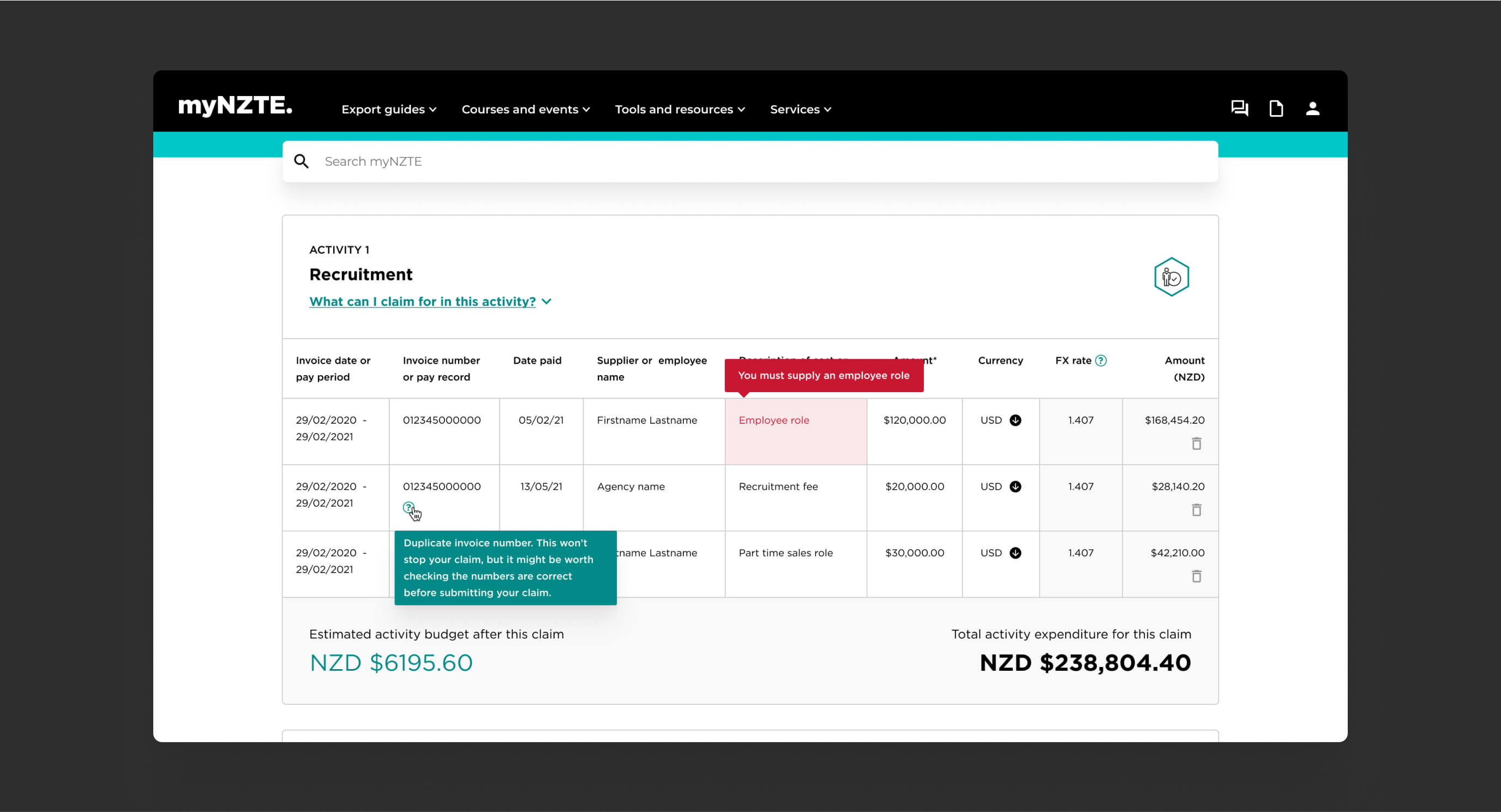

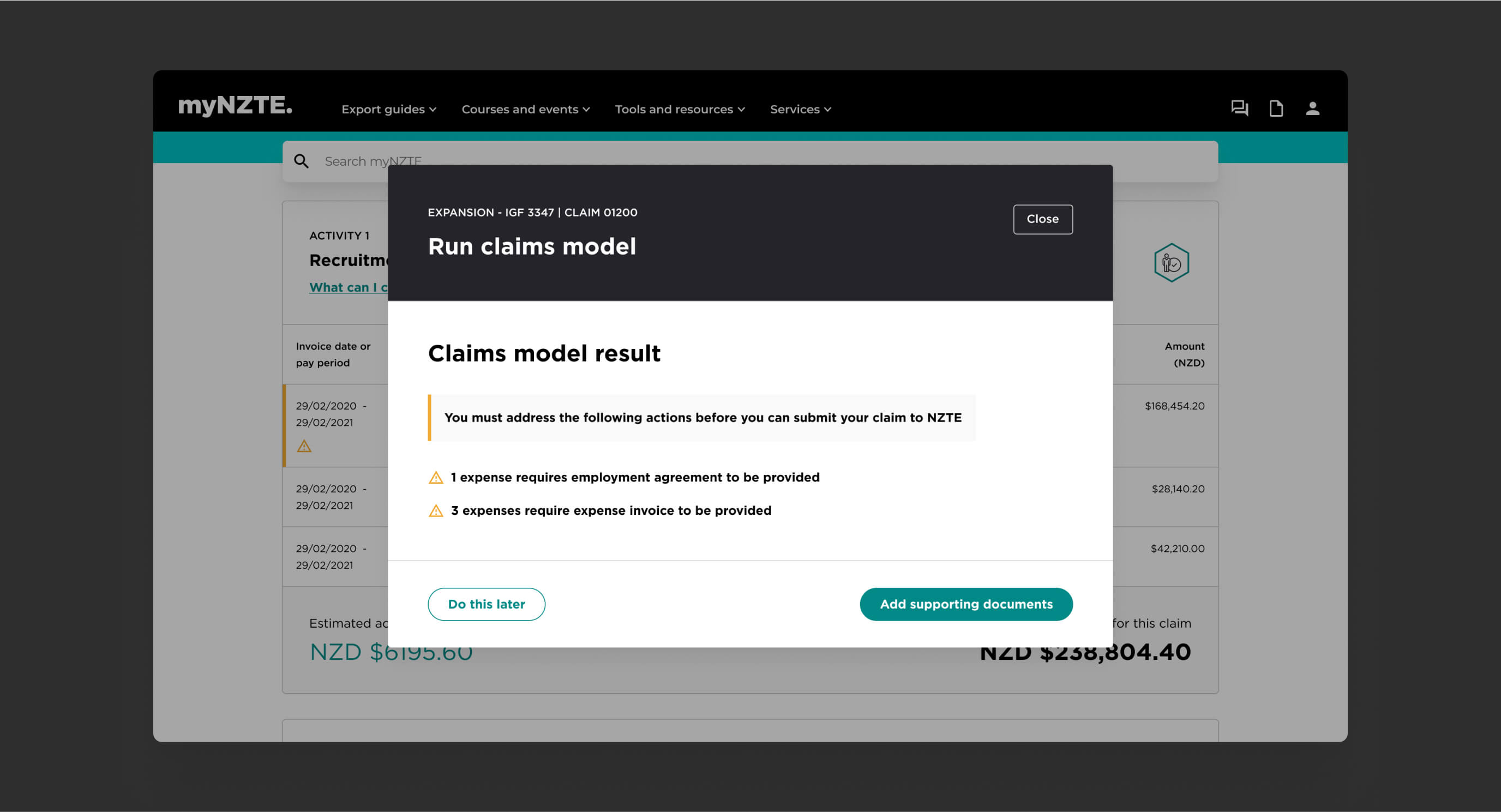

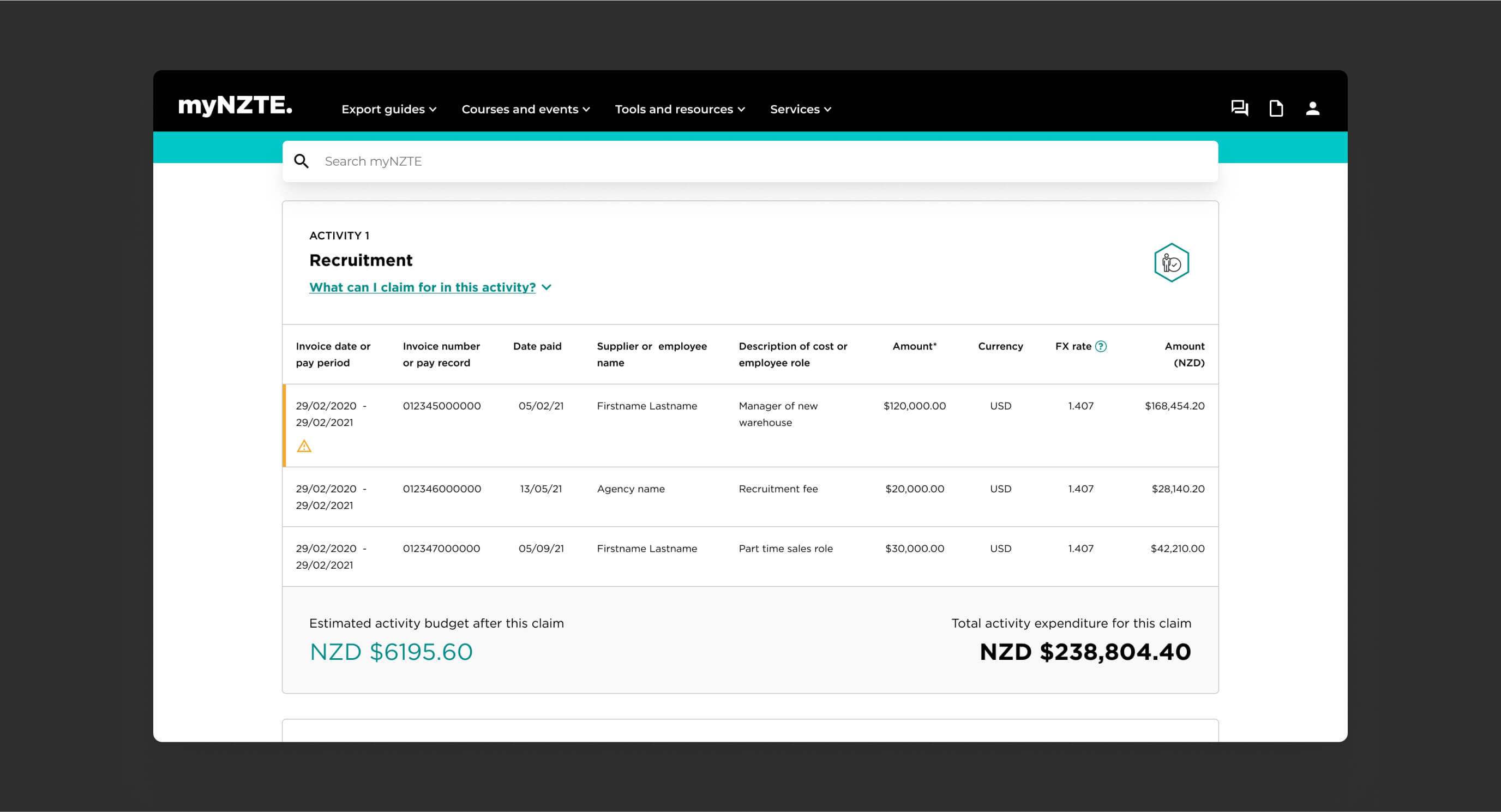

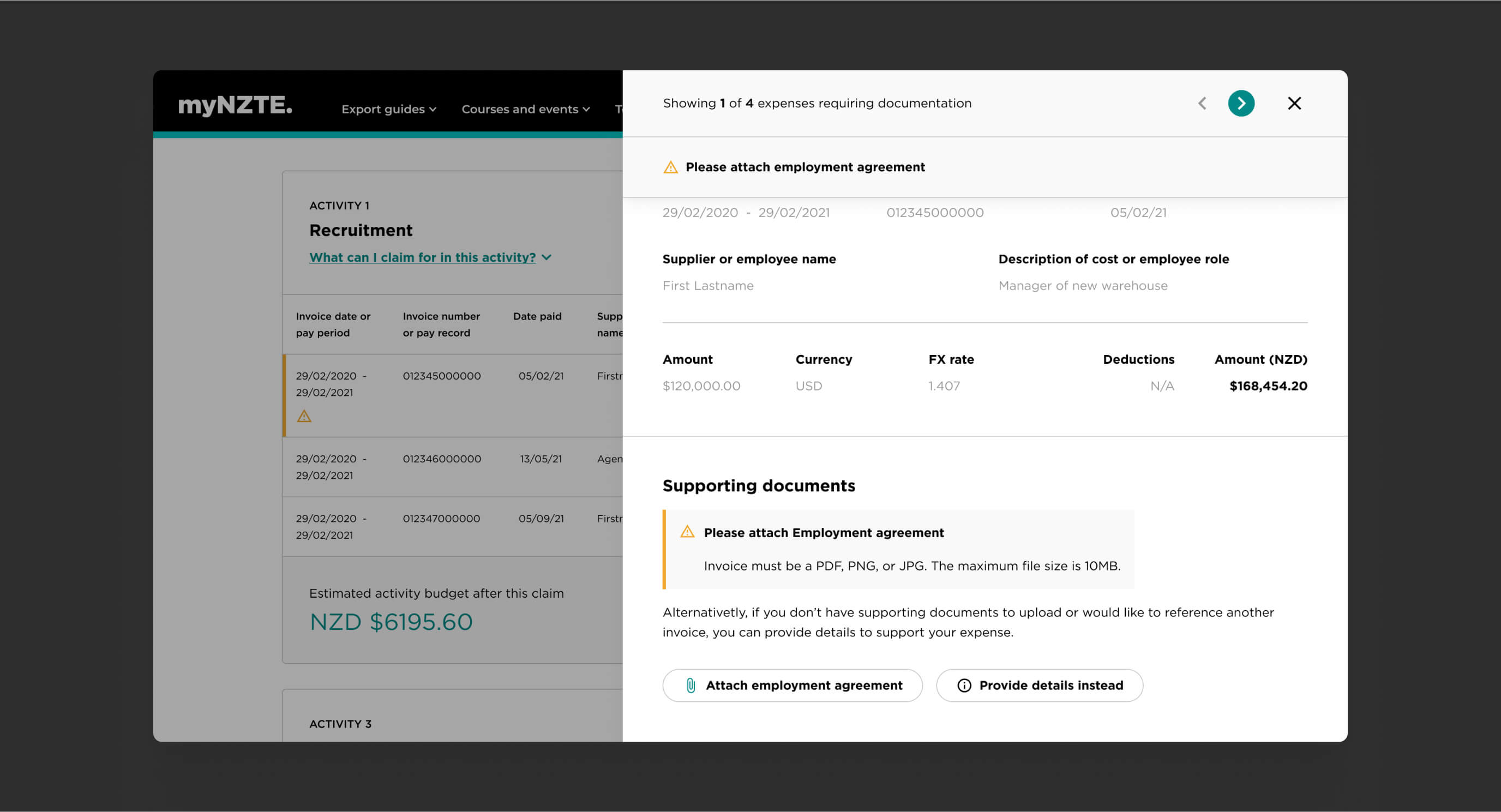

Before customers submitted their claim to the IGF team, we used an AI claims model to test customer claims for errors and missing information. This allowed for customers to rectify any issues before submitting the claim formally tot he IGF team and potentially reducing feedback rounds. This streamlined process aimed to boost the IGF advisory teams efficiency, freeing up time for more complex tasks.

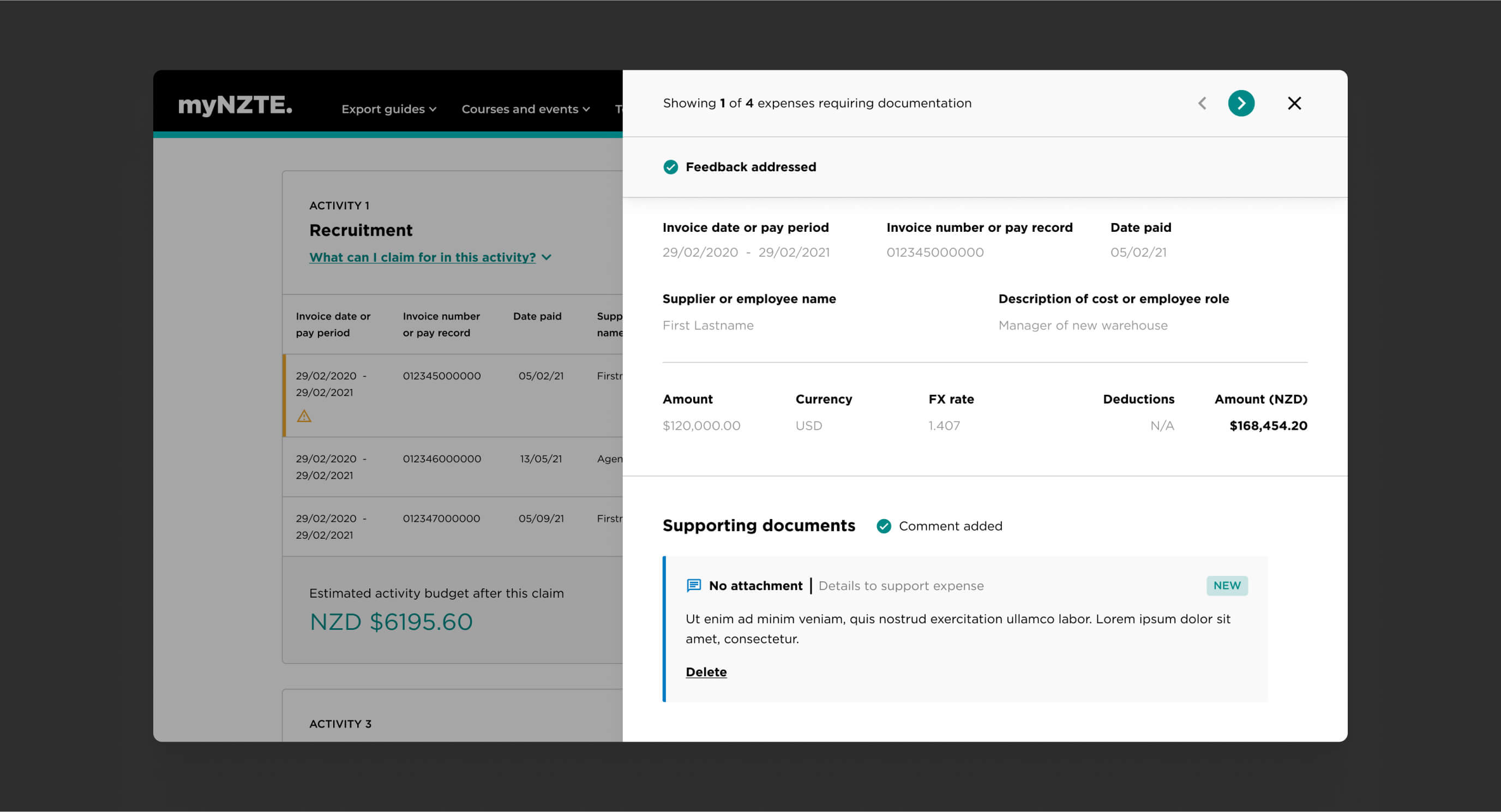

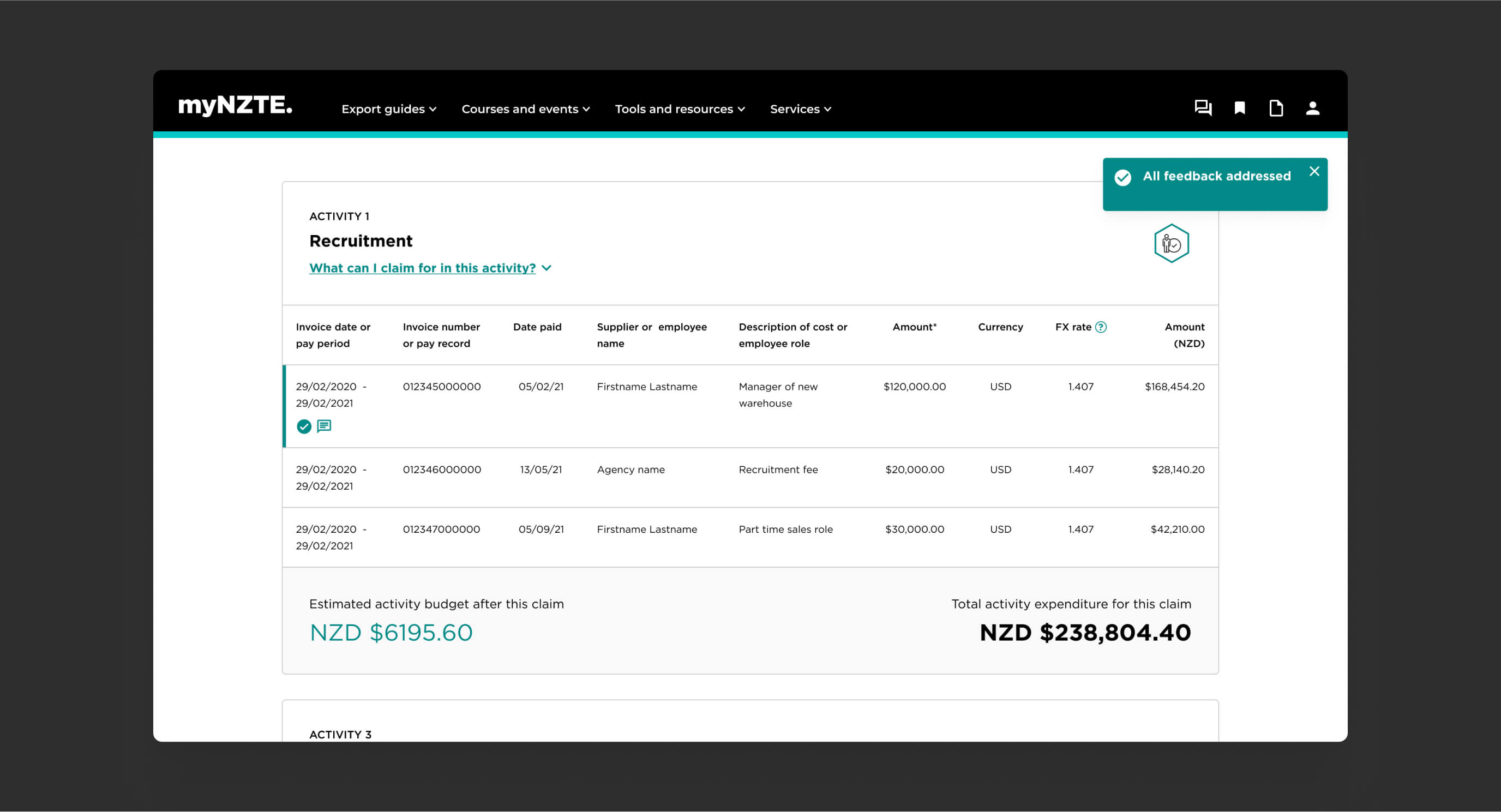

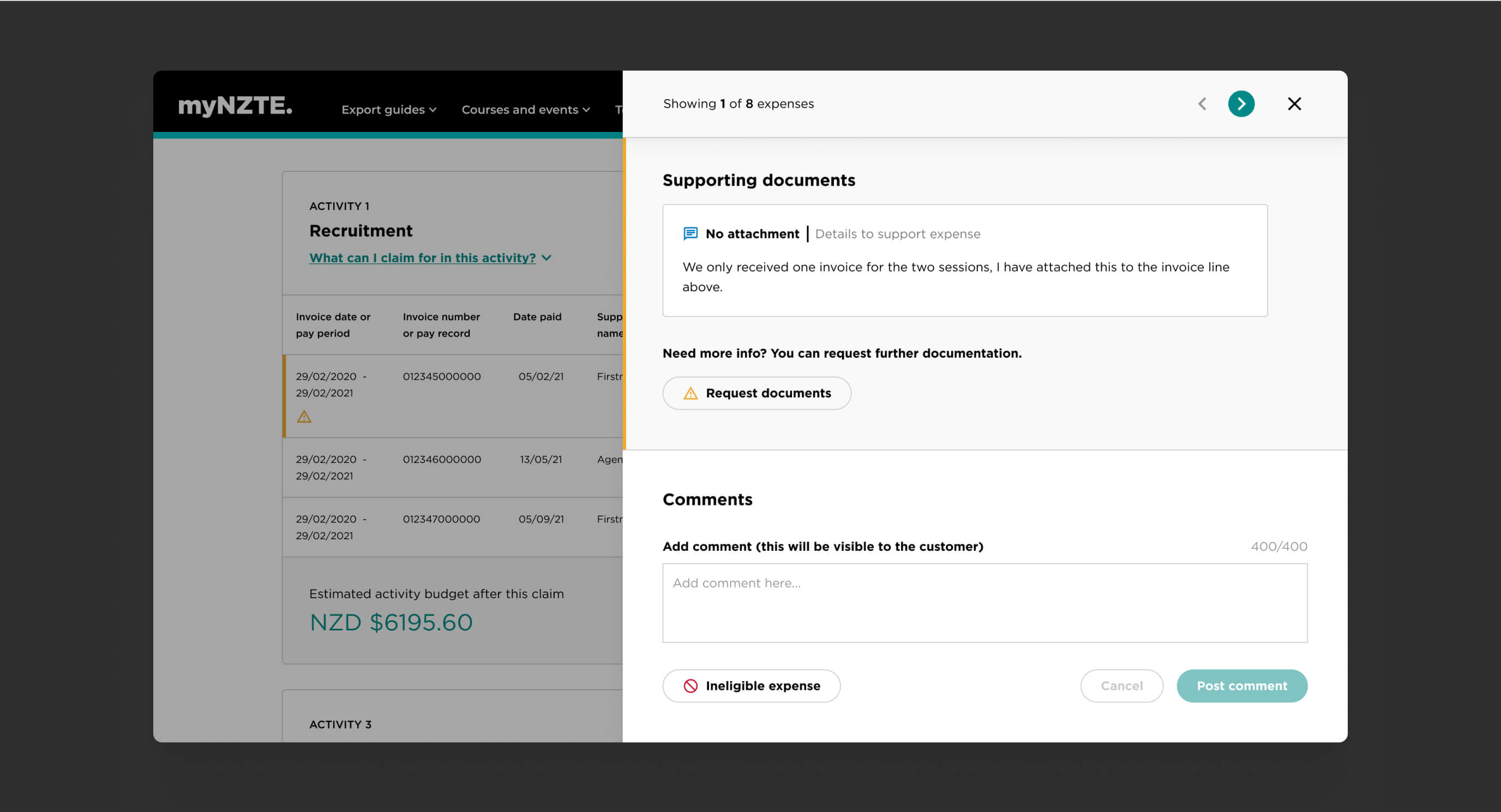

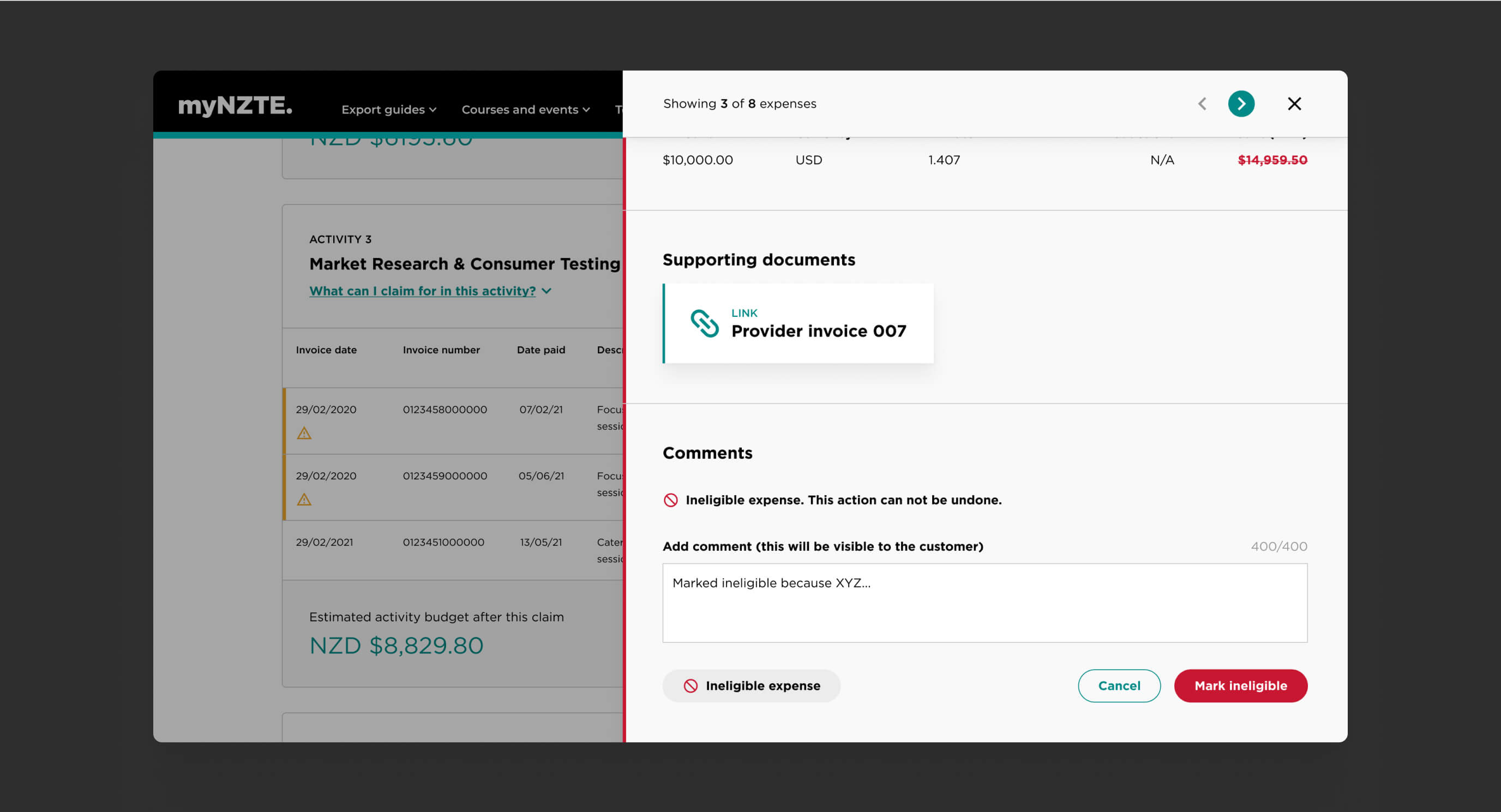

After addressing AI feedback from the claims model, customers could submit their claims for review. We implemented an internal growth fund advisor view of the dashboard, ensuring both customers and the IGF team had identical claim perspectives.

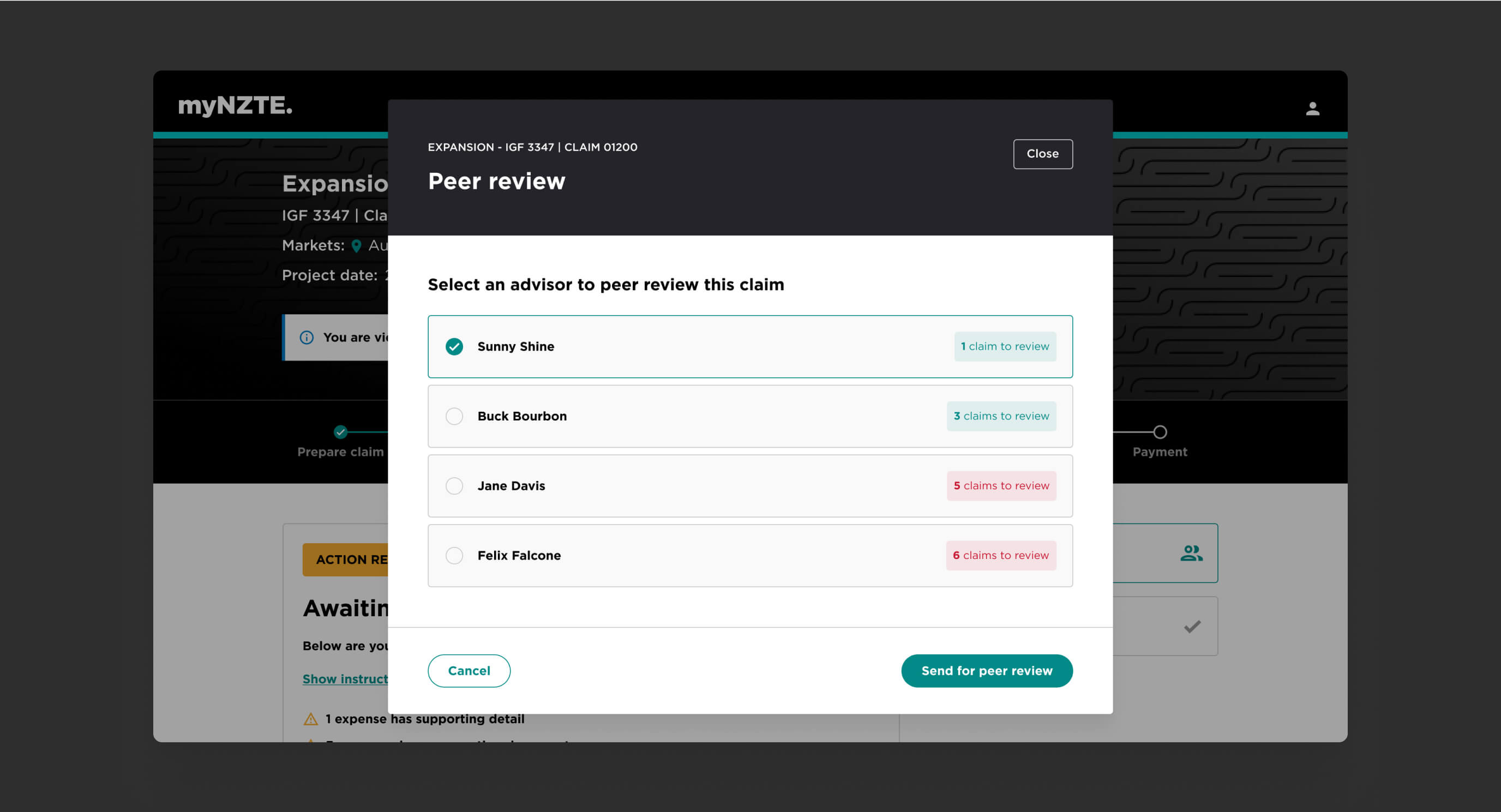

As part of the review process, larger or more complex claims required a peer review. Advisors could nominate peers directly within the platform, while workload indicators ensured peer reviews were distributed evenly among team members.

For the first time, customers had visibility into the status of their current claims and could independently access historical claims directly from their dashboard.

Consolidated claims platform needed for new process

Design playbacks with the whole IGF team and stakeholders

Pages designed across two different platforms

Platforms delivered. Unfortunately, this was never publicly launched

© 2024 Jim Pachal. All trademarks belong to their respective owners. All rights reserved.